Options Pricing Engine

The Options Pricing Engine is a Python-based project I developed to implement financial options pricing models like Black-Scholes, Monte Carlo simulation, and Binomial Tree methods. The goal was to compare these methods under different market scenarios such as at-the-money or high volatility.

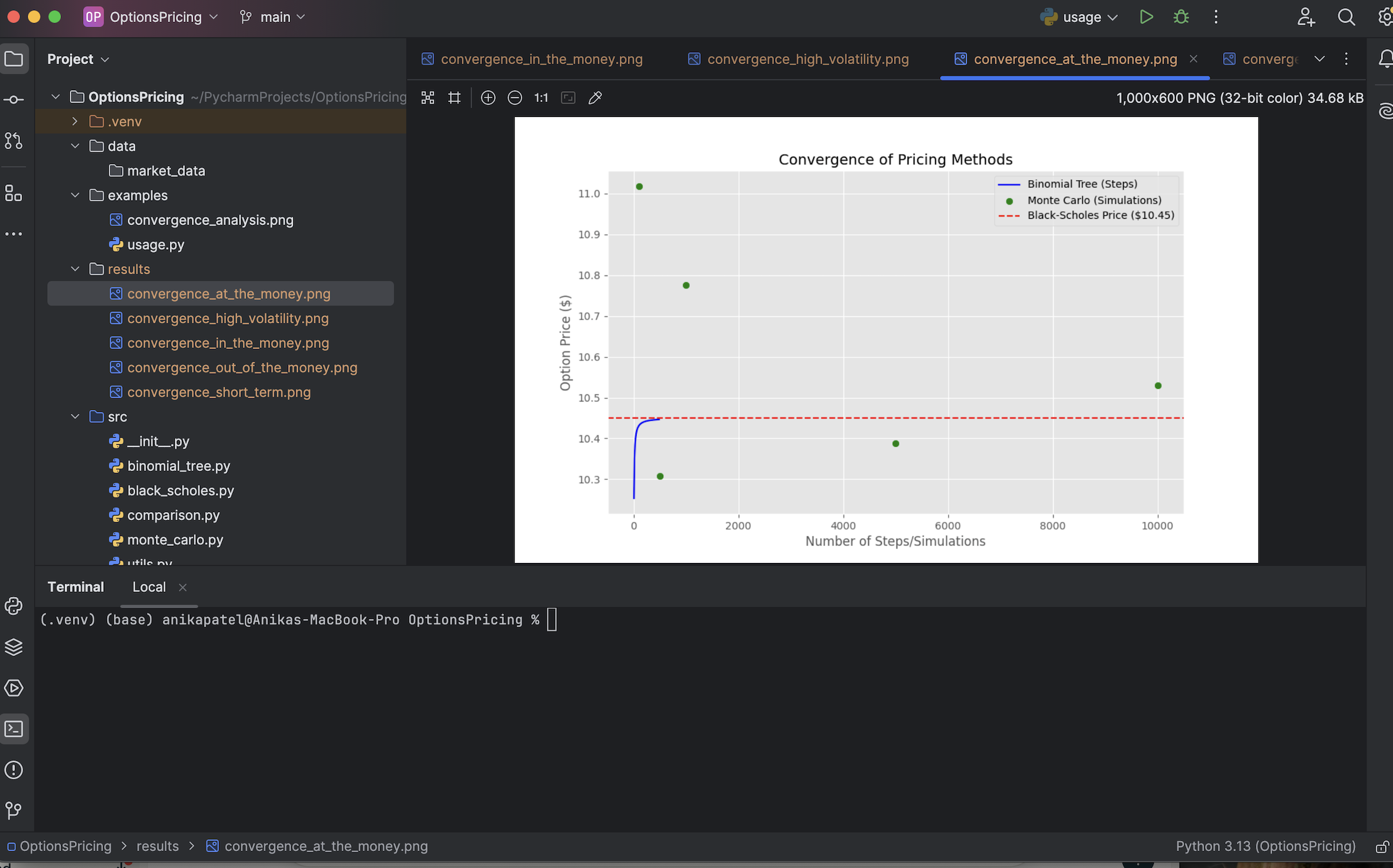

This convergence plot shows how Monte Carlo and Binomial Tree methods approach the analytical Black-Scholes price ($10.45) as the number of steps or simulations increases. The Binomial Tree method converges smoothly, while Monte Carlo exhibits slight variance due to its stochastic nature.

The Options Pricing Engine is organized into modular components to ensure scalability and readability. The project includes:

src/: Contains implementation files for pricing models (Black-Scholes, Monte Carlo, Binomial Tree) and comparison tools.results/: Stores generated visualizations, such as convergence plots for different market scenarios.examples/usage.py: Demonstrates how to use the engine to analyze option prices under various conditions

The engine implements three core pricing methods:

Black-Scholes Model: Analytical pricing for European options.

Monte Carlo Simulation: Numerical pricing with stochastic paths and variance reduction techniques.

Binomial Tree Model: Supports both European and American options, handling early exercise scenarios."